Saving

80/20 Rule

Take Control of Your Money

It’s not easy juggling a tight budget but if you are lucky enough to have surplus money in your budget, you could consider saving or investing.

In an ideal world, 20% of your monthly income would be put towards your savings. You should review your savings account at least once a year to check you’re getting the best rate of interest. Also, consider using your annual Individual Savings Account (ISA) allowance so that you don’t pay tax unnecessarily.

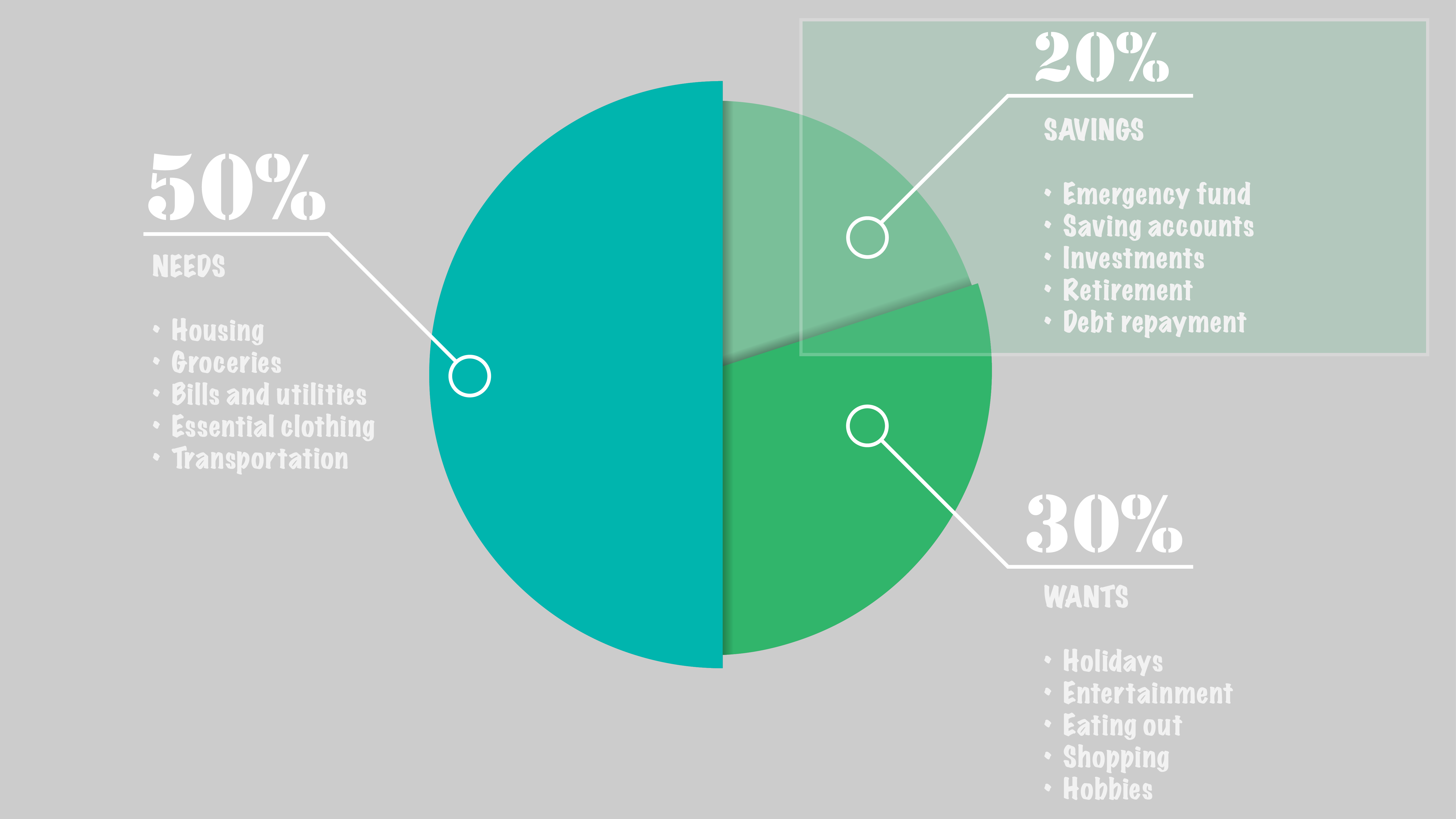

The 80/20 saving rule can be split down further still to help you with budgeting:

Whilst these rules are useful guides, everyone’s situation is different, and some people may find that their spending and saving doesn’t fit these rules.

Emergency Fund

Having some emergency savings is a great way to prepare for unexpected expenses.

A good rule of thumb is to have at least three months’ essential outgoings available in an instant-access savings account. This will give you a cushion should you lose your job or be unable to work.

Tips for saving an emergency fund:

- Visualise your end goal

- Decide how much you need

- Save little and often

- Put it into a separate account so you’re not tempted to borrow from it

- Automate your payments

- Don’t put too much of your savings into an emergency fund – interest rates are likely to be lower in an easy-access account

Savings Accounts

Account Options

A savings account is an account you put money into and in return the bank or building society will typically pay you interest.

Several factors will affect which kind of savings account suits you, including whether or not you will pay tax on the interest, how likely you are to need access to your money, and how long you are prepared to lock it away for.

The personal savings allowance (PSA) allows basic-rate taxpayers to earn £1,000 per year tax-free and higher-rate taxpayers £500.

Some popular types of savings accounts include:

- Cash Individual Savings Accounts (ISAs)

- Junior ISAs

- Lifetime ISAs

- Instant access savings account

- Regular saver accounts

- Notice account

- Fixed-rate bonds

- Off-shore savings accounts

An Individual Savings Account (ISA) is a tax-free saving or investment account. Types of ISAs include Cash ISAs, Stocks and shares ISAs, Junior ISAs and Lifetime ISAs.

In the 2023 to 2024 tax year, the maximum you can save in an ISA is £20,000, JISA £9,000 and LISA £4,000. You can put money into one of each kind of ISA each tax year.

What are the benefits of an ISA?

- Your money will grow tax-free

- The annual allowance for the current tax year is £20,000 and starts afresh each new tax year

- You can transfer existing ISAs into a new ISA

- Children aged between 16 and 18 can hold both a Junior and a standard Cash ISA

- Specific ISAs are available to help when saving towards your first home or retirement.

A savings account is an account you put money into and in return the bank or building society will typically pay you interest.

Savings interest is tax-free and most people won’t pay any tax on it. The personal savings allowance (PSA) allows basic-rate taxpayers to earn £1,000 per year tax-free and higher-rate taxpayers £500.

There are different types of saving accounts:

- Easy-access savings – you can withdraw money whenever you want which is useful if you might need to dip into them. Interest rates are usually lower than on fixed savings accounts because you pay for the flexibility. There may be a limit to the number of cash withdrawals that can be made in a given time period though so it is important to fully understand the terms.

- Notice accounts – require you to give notice before you can withdraw your cash. Can be useful if you know you will need your money, but are not sure when i.e. if you have a deposit to buy a home. Generally offer better interest rates than an easy-access account but less than a fixed rate as still offers some flexibility. If you require access to your funds outside of the terms of your account you may be subject to a fine and/or interest penalty or not be able to get access at all.

- Regular saver accounts – with a regular savings account, also known as monthly savers, you commit to paying in a certain amount each month. They are designed for people to save some of their income every month rather than depositing a lump sum. In return, the bank or building society may offer you a higher interest rate than you’d get with a current account or ordinary savings account.

A savings account will typically pay variable rates of interest, whereas a bond is normally fixed for a set term.

Fixed-rate bonds are a type of fixed-rate savings account. They offer higher rates of interest compared to easy-access products, but you must be prepared to lock your money away for a fixed period of time. Typically, the longer you commit to leaving your savings untouched, the higher your interest rate will be.

In return, you get a better interest rate that is guaranteed for the term of the bond. You should only lock away money that you definitely won’t need access to or you will incur penalties.

Offshore accounts are savings accounts located outside the account holder’s country of residence. They are often operated in a different currency.

Offshore accounts are offered by many high street banks and building societies as well as private banks. In many cases, there may be a fee and higher deposit requirements than an onshore account.

Reasons to open an offshore account include:

-

Live or work abroad

-

Planning to move abroad, i.e. to retire

-

Move countries regularly for work

-

Make frequent business trips between countries

-

Get paid in a foreign currency, i.e. for freelance work

-

Own assets abroad such as investments, or property

-

Have family members abroad who you support financially

Banking offshore may have potential tax benefits for you. However, tax rules differ from country to country. If you’re unsure about your personal tax obligations, you should seek professional advice. Offshore accounts are not protected by the Financial Services Compensation Scheme (FSCS), which protects savings held with authorised UK banks and building societies, up to £85,000 per person. However, some of them are covered by other schemes.

If you’re claiming certain benefits, you can also use the Help to Save scheme which gives you a bonus of 50% on savings paid into a Help to Save account.

Interest Rates

Interest Rates Explained

An interest rate tells you how high the cost of borrowing is, or how high the rewards are for saving. The Bank of England (BoE) sets the bank rate (or ‘base rate’) for the UK.

It is important because it influences many other interest rates in the economy. That includes the lending and savings rates offered by high street banks and building societies. Higher interest rates make it more expensive for people to borrow.

It’s not all bad news when interest rates go up. If you’re a saver you could see an increase in the rates you are getting on variable rate saving accounts and Cash ISAs.

Banks and building societies may compete to offer the best interest rates on savings accounts. This means it’s important to shop around to make sure you have the right account for you with the best interest rate.

This video from the Bank of England helps explain interest rates and why they matter:

Pensions

Saving for Retirement

A pension is a pot of cash that you, and your employer, can pay into – which you get tax relief on – as a way of saving up for your retirement.

It is a tax-efficient way to put money aside for later in life, to provide income for when you retire. It is best to put in as much as possible, as early as possible.

Depending on the type of pension you have, you and your employer can pay into it. The government also ‘contributes’ to your pension in the form of tax relief.

Once you turn 55 (expected to rise to 57 in 2028) or retire, you have a number of options for how you choose to take your pension income.