Cash Flow Modelling

Overview

Forecasting your financial future.

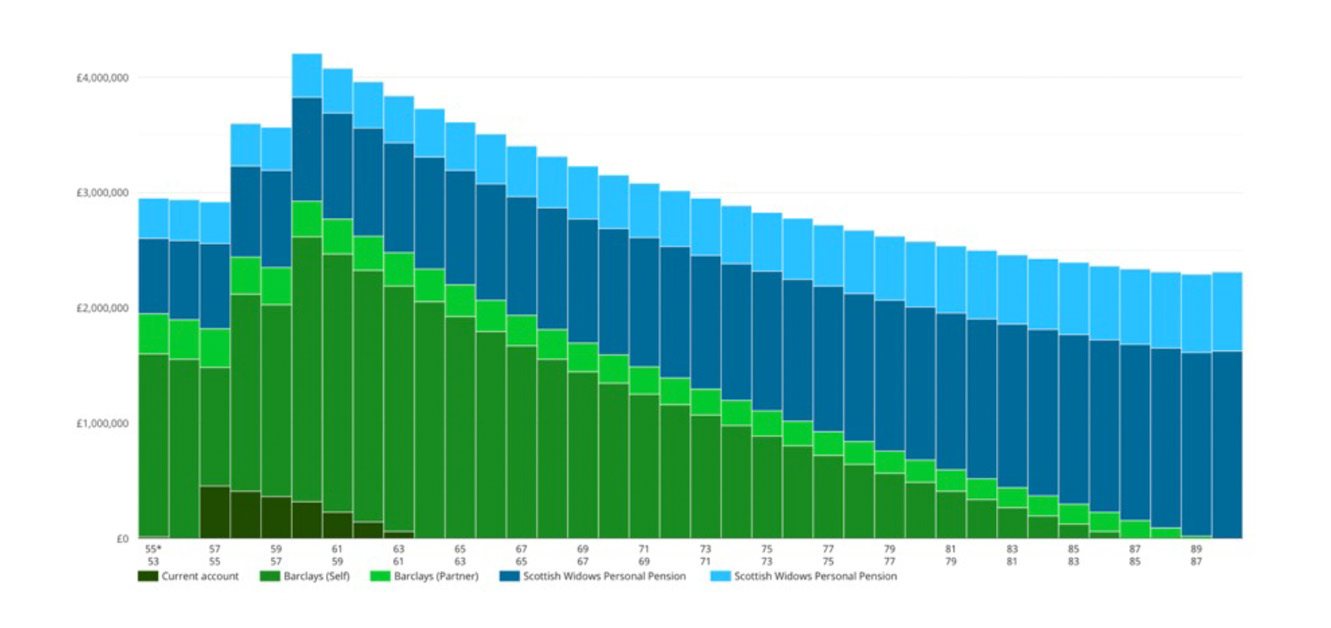

Cash flow modelling is used by financial planners to illustrate your current financial position relative to your objectives. It can help put plans in place to achieve your financial life goals and answer questions such as ‘do I have enough money?’ and ‘when can I afford to retire?’

What is it used for?

Cash flow modelling can assist in planning and achieving financial objectives by visualising cash flow now and into the future. It can:

- Show if you will have enough money to retire when you would like to

- Show if you could achieve your desired lifestyle in retirement

- Help to utilise tax allowances including Inheritance Tax (IHT) planning

- Help to identify any potential surplus or shortfall in cash flow

- Plan a number of ‘what if’ scenarios and illustrate how they would impact your goals

- Highlight how seemingly minor changes have the potential to dramatically change your financial future

How it Works

Planning for the Unexpected

You can run through many different scenarios to see how they might affect your finances. For example:

- Can you bring your retirement forward?

- What if you fell ill and were unable to work?

- Changes in the expected return on your investments or simulating a fall in the market

- See how taking income from different sources could affect your tax bill and your overall finances over time

Review Regularly

Financial plans should be reviewed regularly and at least every 12 months to:

- Reflect changes in personal circumstances

- Review your goals, they may change

- Keep track of progress

- Take regulatory changes into account

- Give you confidence

Even seemingly small changes in circumstances can mean there is a better path towards your financial goal.

Our advisers

Your adviser will work with you to understand your current situation and appetite for risk. All of the advice given will be tailored to you, your circumstances and your objectives.

You will be supported throughout your financial planning journey from setting long-term financial goals and working towards targeted growth, right through to retirement and taking income.