‘The first cut is the deepest’. In the third quarter, we saw the first interest rate cuts of this cycle in the UK and US. We also witnessed bouts of volatility in markets, triggered by the combination of weaker employment data in the US and investors unwinding the Japanese yen carry trade. As the quarter progressed, however, calmness returned. The summer months can often be a more volatile ride because of holidays contributing to lower liquidity in markets.

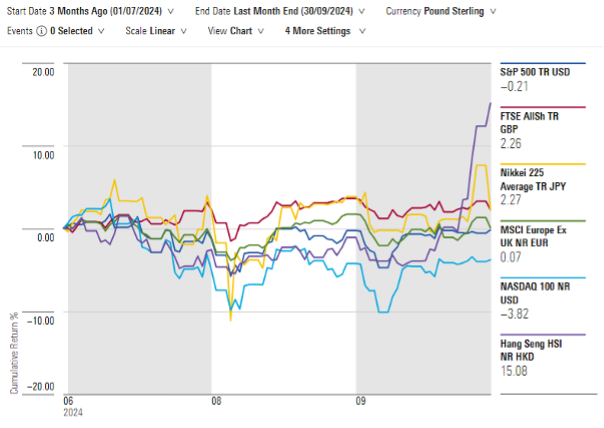

The biggest market gyrations were in Japan, with an interest rate increase causing the yen to strengthen against other major currencies and the stock market coming under pressure. UK and US equity markets were also under pressure, but less so. As the quarter progressed, markets regained their composure and eked out positive returns.

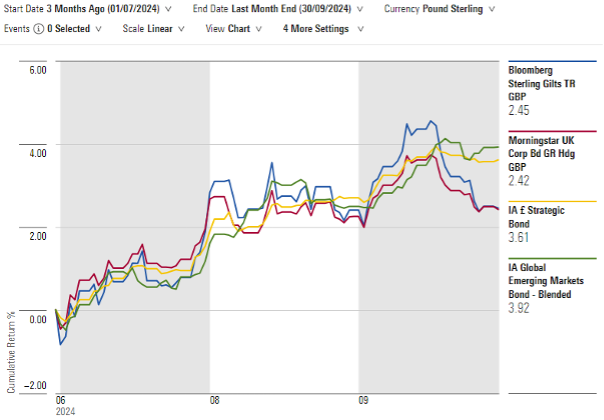

With inflation back at the Bank of England target alongside lacklustre growth in the UK, we always felt it was a matter of when the first interest rate cut would come in the UK. That duly came on the first day of August with interest rates falling from 5.25% to 5%. The Federal Reserve also reduced US rates in September, delivering a surprise cut of 0.50%. We anticipate that this will be the first of several interest rate reductions over the coming year, but how far rates fall in the US and the UK will ultimately be dependent upon the health of each economy.

Much of the last year has been focussed on the Artificial Intelligence phenomenon, with Nvidia being the main beneficiary of this transition. It was therefore interesting to view their financial results when they were released in August. The company continues to grow as they recorded $30.04bn in revenue over the past three months, a 122% jump from the previous year. The news was not enough to support the share price and despite this level of growth the shares slipped from their highs.

The Chinese economy has been under pressure over the last few years as its over indebted property market has been a dark cloud impacting individuals and the banking system. This has had a knock-on impact on investors’ confidence with the Chinese stock market falling over sixty per cent since February 2021. At the end of the quarter a raft of stimulus measures was announced by the People’s Bank of China (PBOC). Measures included plans to lower borrowing costs and allow banks to increase their lending. The Chinese Communist Party’s politburo, also signalled that the government would borrow money to fund investment spending. It was, however, unclear whether this would be funded with further bond sales beyond what has already been announced. Nonetheless, these moves caused the Chinese stock market to bounce strongly, with the Hang Seng up 16%* in September.

Looking forward, we continue to be optimistic on the outlook for markets, with bonds still offering attractive yields in a falling interest rate world. Equity markets also look good value, supported by dividends, share buybacks, and a raft of merger and acquisition activity.