As a new tax year approaches, it is important to ensure you are in the best financial position to help protect and grow your future wealth.

Our Bitesize Tax Planning provides you with details of the key allowances and reliefs available to you. The tax planning tips are available in easy to consider sections.

This article looks at Pensions including; Pension Annual Allowance, Tapered Annual Allowance, Maximum Reduction and Rounding Down, and Contributions and Annual Allowance Charge.

Pension Annual Allowance

Making the most of the Pension annual allowance is a particularly attractive option for higher earners as we approach the end of the tax year.

Personal tax relief applies to pension contributions, although this may be restricted by the annual allowance or net-relevant earnings.

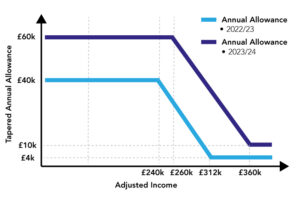

The annual allowance for 2023/24 is £60,000 for those with an adjusted annual income from all sources, including pension contributions, of £260,000 or under a threshold income of £200,000 or less.

An individual’s annual allowance reduces by £1 for every £2 of adjusted income over £260,000 – down to a minimum of £10,000, although this usually applies to those with a total income of £312,000 or more. See more on Tapered Annual Allowance here.

Provided you had a pension fund during a previous tax year, it is possible to carry forward any unused allowances, up to a maximum of three years.

More information can be found here: https://www.gov.uk/tax-on-your-private-pension/annual-allowance

Tapered Annual Allowance

The annual allowance for pensions is currently £60,000 for the 2023-24 tax year. Providing they have sufficient income, individuals can contribute, or have contributions made on their behalf (by their employer for example), up to £60,000 in total this tax year to their pension pots without incurring tax charges.

However, since 6 April 2023, people with an Adjusted income (which includes employer pension contributions) over £260,000 will have their annual allowance for that tax year restricted.

This means that for every £2 of adjusted income they have over £260,000, their annual allowance is reduced by £1. This only applies if their threshold income (broadly total taxable income less their own pension contributions) is above £200,000.

Maximum Reduction and Rounding Down

The maximum reduction is £50,000. The tapering of the allowance stops at £360,000 of adjusted income and so everyone will retain an allowance of at least £10,000. People with high income caught by the restriction may have to reduce the contributions paid by them and/or their employer or an annual allowance charge will apply.

It is important to note that the reduction to the annual allowance is rounded down to the nearest whole pound, adding an additional layer of precision to the calculation.

Contributions and Annual Allowance Charge

To circumvent the repercussions of the tapered annual allowance, affected individuals should strategise their pension contributions effectively. This may involve reducing personal and/or employer contributions to align with the reduced annual allowance. Failing to make adjustments, if the excess cannot be covered by carrying forward unused allowances from previous years, could result in an annual allowance charge.

More on tapered annual allowance can be found here: https://www.gov.uk/guidance/pension-schemes-work-out-your-tapered-annual-allowance

If you would like to discuss anything mentioned in this article, please contact us.

Download our Tax Year End Checklist to assist with your tax planning below.

See the other topics in our Bitesize Tax Planning series:

- Check Your Tax Code

- Personal Allowances

- Savings & Investments

- Dividend Allowance

Personal circumstances differ and not all of this information is applicable to every client and/or their business, this information is general in nature and should not be relied upon without seeking specific professional financial advice.

The Financial Conduct Authority (FCA) does not regulate tax advice, estate planning, trusts or will writing.

The content in this article is for your general information and use only and is not intended to address your particular requirements. Articles should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice.

Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles.

Thresholds, percentage rates and tax legislation may change in subsequent finance acts. Levels and bases of, and reliefs from, taxation are subject to change and their value depends on the individual circumstances of the investor. The value of your investments can go down as well as up and you may get back less than you invested. Past performance is not a reliable indicator of future results.

Pareto Financial Planning Limited is authorised and regulated by the Financial Conduct Authority (FCA).