As a new tax year approaches, it is important to ensure you are in the best financial position to help protect and grow your future wealth.

Our Bitesize Tax Planning provides you with details of the key allowances and reliefs available to you. The tax planning tips are available in easy to consider sections.

This article looks at Personal Allowances including; Tax-Free Personal Allowance, Savings and Investments and Dividend Allowance.

Tax-Free Personal Allowances

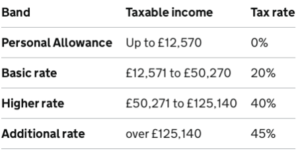

The personal allowance for the current tax year stands at £12,570. Income beyond this threshold is subject to varying tax rates ranging from 20% to 45% depending on the amount earned.

Individuals earning between £100,000 and £125,140 may face a higher marginal tax rate due to a reduction in the personal allowance. For every £2 earned above £100,000, the personal allowance decreases by £1. Consequently, those with non-savings and savings income within this bracket could experience an effective tax rate of 60% for this tax year.

Moreover, couples meeting specific criteria may be eligible to transfer £1,260 of their unused personal allowance to their spouse or civil partner, a provision known as marriage allowance. This arrangement has the potential to save couples up to £252 in income tax for the tax year.

Savings and Investments

The personal savings allowance allows a basic-rate taxpayer to receive up to £1,000 in savings income tax-free. A higher-rate taxpayer can get up to £500 in savings income without any tax being due. There is no relief for additional-rate taxpayers.

If you earn less than £17,570 annually, you may be able to receive up to £5,000 in savings interest without paying tax on it. This is known as the starting rate for savings.

Dividend Allowance

The first £1,000 of income from dividends in 2023/24 is tax-free, while income from dividends that exceeds this amount is usually taxed at rates of 8.75%, 33.75% or 39.35%. In 2024/25, this will be halved to £500, so use the most of your allowance while you can.

More information can be found at: https://www.gov.uk/income-tax-rates

If you would like to discuss anything mentioned in this article, please contact us.

Download our Tax Year End Checklist to assist with your tax planning below.

See the other topics in our Bitesize Tax Planning series:

- Check Your Tax Code

- Personal Allowances

- Savings & Investments

- Dividend Allowance

Personal circumstances differ and not all of this information is applicable to every client and/or their business, this information is general in nature and should not be relied upon without seeking specific professional financial advice.

The Financial Conduct Authority (FCA) does not regulate tax advice, estate planning, trusts or will writing.

The content in this article is for your general information and use only and is not intended to address your particular requirements. Articles should not be relied upon in their entirety and shall not be deemed to be, or constitute, advice.

Although endeavours have been made to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No individual or company should act upon such information without receiving appropriate professional advice after a thorough examination of their particular situation. We cannot accept responsibility for any loss as a result of acts or omissions taken in respect of any articles.

Thresholds, percentage rates and tax legislation may change in subsequent finance acts. Levels and bases of, and reliefs from, taxation are subject to change and their value depends on the individual circumstances of the investor. The value of your investments can go down as well as up and you may get back less than you invested. Past performance is not a reliable indicator of future results.

Pareto Financial Planning Limited is authorised and regulated by the Financial Conduct Authority (FCA).